Pattern Recognition

When people tell me they learn from experience, I tell them the trick is to learn from other people’s experience.

- Warren Buffett

What is Pattern Recognition?

In psychology and cognitive neuroscience, pattern recognition describes a mental process that matches information from a stimulus with information retrieved from memory. Pattern recognition creates an impulse to always connect new knowledge to old. It helps knowledge snowball, as interests in new knowledge genuinely build onto the old knowledge.

Pattern recognition is one of the most important mechanisms of chess improvement. Realizing that the board's position has similarities to positions you played before helps you to grasp the essence of your positioning quickly.

Alice Schroeder, the author of “The Snowball, Warren Buffett and the Business of Life,” states that “Buffett finds that the more he reads about disparate topics or historical events and circumstances that seem to have no connection, the more he can discern pattern recognition.“

Buffett's knowledge acquired from a lifetime of reading allows him to select from his mental model's toolbox to assist him in investment problems he may face.

Case Studies: Learn From Other’s Mistakes

It’s good to learn from your mistakes. It’s better to learn from other’s mistakes.

- Warren Buffett

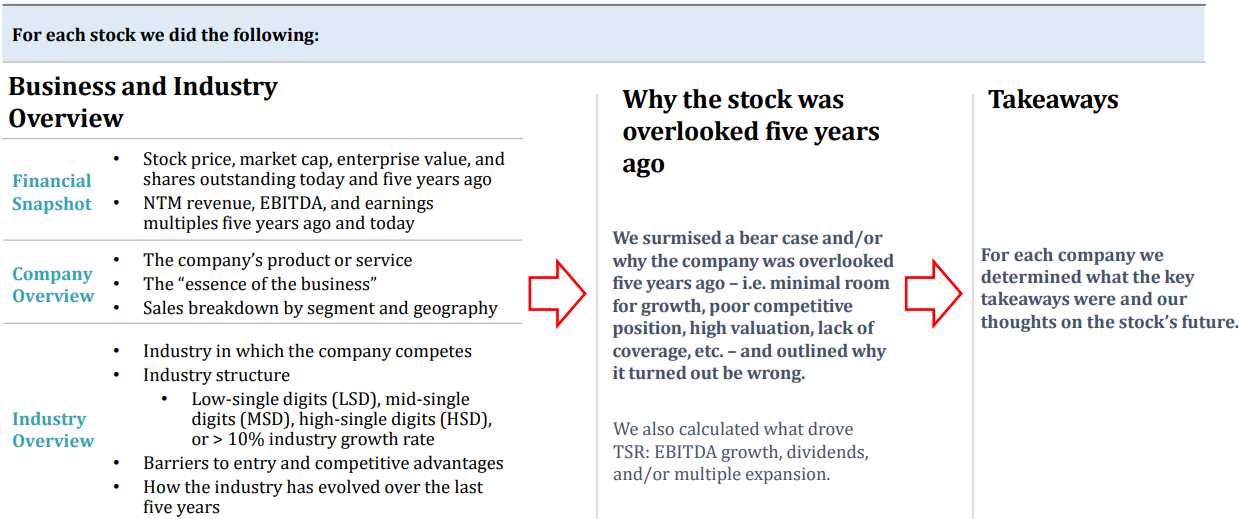

In a recent podcast with Connor Haley of Alta Fox Capital, he stated that he had printed out a binder of every stock that had a 5x increase or more on Value Investors Club (VIC) along with all the comments. Doing this, Haley had been able to deep dive a wide variety of investment examples that became real winners and see comment by comment investor sentiment, bear case arguments, and mistakes investors had made along the way. From analyzing hundreds of investment case studies, Haley began developing pattern recognition strategies that he has now carried over to Alta Fox.

On the podcast, Connor states that he uses pattern recognition to find the best and highest quality small-cap businesses, exploiting the structural alpha opportunity in the small and microcap space.

When time is limited, it is crucial that we learn from other people’s mistakes and leverage the experiences of others. If you can get a broad set of examples of other people's mistakes, it is equivalent to living multiple lives and learning in a much broader way than committing errors yourself.

Although learning from your own mistakes is useful, it’s even more useful to leverage other people’s mistakes so you can improve faster with a larger supply of examples. The more situations you can identify with, the more accurately you’ll be at gauging risk and being able to estimate the probability of success on any given investment.

Small-Cap Case Study: