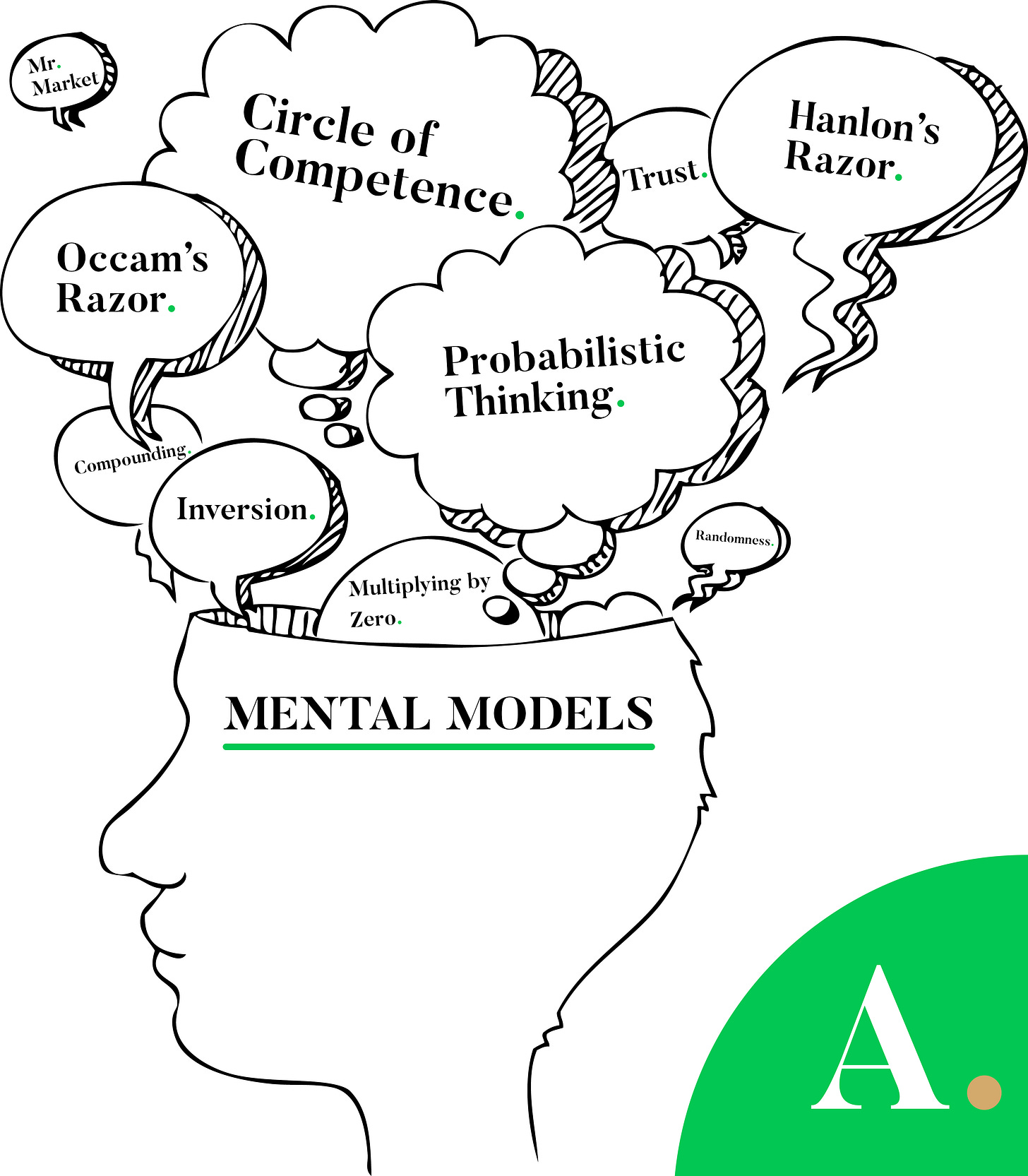

An Introduction to Mental Models

The smartest way to improve your decision-making skills is to learn mental models. A mental model is a framework or theory that helps to explain why the world works the way it does. Each mental model is a concept that helps us make sense of the world and offers a way of looking at the problems of life.

“The quality of our thinking is proportional to the models in our head and their usefulness in the situation at hand. “

- Shane Parish

In a famous speech in the 1990s, Charlie Munger summed up the approach to practical wisdom through understanding mental models by saying: “Well, the first rule is that you can’t really know anything if you just remember isolated facts and try and bang ’em back. If the facts don’t hang together on a latticework of theory, you don’t have them in a usable form. You’ve got to have models in your head. And you’ve got to array your experience both vicarious and direct on this latticework of models. You may have noticed students who just try to remember and pound back what is remembered. Well, they fail in school and in life. You’ve got to hang experience on a latticework of models in your head.”

Detailed below is a brief overview of Augury’s top 5 investing mental models.

Circle of Competence

Probabilistic Thinking

Margin of Safety

Scenario Analysis

Inversion

Circle of Competence

Circle of competence, related to the medical field as “scope of practice,” is a simple mental model that has the potential to drastically improve your success rate as an investor.

Having the awareness to be able to weigh factors you don't understand correctly is equally as important as appropriately weighing factors you do understand. Considering factors of uncertainty can better equip you for decision-making tasks which lead to more positive outcomes.

Our disciplined risk aversion throughout 2011 enabled us to avoid dangerous temptations and remain focused on investments in our areas of strength and competitive advantage. – Seth Klarman

Growing your circle of competence, like many things in investing, is a balance between deserved confidence and humility. It’s not the size of your circle of competence that matters, but rather how accurate your assessment of it is. Investing has style, some investors focus on figuring out incredibly complex investments, others focus on taking advantage of a broader set of opportunities. Don’t try to keep up with the Jones’s. Figure out what feels comfortable, and do that.

Probabilistic Thinking

Probabilistic thinking is essentially trying to estimate, using some tools of math and logic, the likelihood of a specific outcome. As it relates to investing largely estimating the risk/reward. Thinking in probabilities is the best tool we have to improve the accuracy of the predicted outcome of our investments.

Subjective probabilities help investors to make implicit assumptions explicit. Forming explicit assumptions is the reason why operating models and DCF’s are a core element of our research process. Facilitating comparisons and creating feedback loops are necessary to learn and understand how minor changes can affect potential outcomes. Subjective probability estimates can require frequent updating as new information/evidence is uncovered.

Probabilistic thinking helps us identify the most opportunistic outcomes which lead to decisions that are more selective and effective.

Margin of Safety

Margin of safety is the difference between the intrinsic value of a stock and its market price. This model starts with assessing risks and the downside before focusing on potential returns. It’s is all about the price you pay. Margin of safety is designed to make you money by not losing money. Outside of investing, it’s a fundamental core to many applications.

A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable and rapidly changing world.

– Seth Klarman

Margin of safety is essential in bridge building. Let’s say we calculate that on an average day, a proposed bridge will be required to support 5,000 tons at any one time. Do we build the structure to withstand 5,001 tons? I’m not interested in driving on that bridge. What if we get a day with much heavier traffic than usual? What if our calculations and estimates are a little off? What if the material weakens overtime at a rate faster than we imagined? To account for these, we build the bridge to support 20,000 tons. Only now do we have a margin of safety. Source: Farnam Street

Scenario Analysis

Scenario analysis is a process of forecasting and analyzing multiple possible outcomes. This model suggests that working through multiple future outcomes both from a bearish and bullish perspective will allow you to not become attached to a possible outcome based emotion.

At Augury we model out best, base, and worst-case scenario and assign probabilities to each given outcome. Planning can reduce the amount of anxiety if a given situation does transpire while also allowing us to

devise a plan to respond to a negative outcome rationally rather than emotionally.

Inversion

Inversion is a way of thinking, in which you consider the opposite of what you want. When I first learned of it, I didn't realize how powerful and applicable it could be for investing and everyday life. Inversion is a rare and crucial skill that nearly all great thinkers use to their advantage.

“Think forwards and backwards — invert, always invert. Many hard problems are best solved when they are addressed backward. The way complex adaptive systems work and the way mental constructs work is that problems frequently get easier, I’d even say usually are easier to solve, if you turn them around in reverse.”

- Charlie Munger

Applying Inversion

Define the problem: What is the problem you are trying to solve?

Inverted: How could you guarantee the failure of your objective?

Solutions: What would you have to do to avoid the failure that you identified in the previous step?